This post contains affiliate links. If you make a purchase through these links, I can earn a commission at no extra cost to you. Thank you!

I don’t know about you, but my travel dreams are always bigger than what I have the budget for. I save what I can and have adjusted some of my monthly expense to allow me to save a little bit more. But it still isn’t enough.

I want to travel more but spend less money doing it. A lot less.

That’s where using credit card points and miles comes in. My favorite point earning card is the Chase Sapphire Preferred!

Hey, if I can travel better by using a credit card that rewards me with travel benefits that I can ACTUALLY USE, and I can do it with normal everyday spending, I’m in!

What are Points and Miles?

“Points and Miles” is a common term when talking about travel credit cards. It’s a reward system that credit cards use.

For every dollar you spend on the card, you earn 1X or more in points or miles. $1 = 1 point. Some cards go as high as 5X the points for every dollar!

You receive these points or miles simply by using the credit card.

You probably already have one or two of these types of travel credit cards.

I used a sign-up bonus to fly roundtrip to Switzerland!

Sign-up Bonuses

Many credit cards will offer you an attractive sign-up bonus. This is where you would earn a pretty hefty number of points for spending a certain amount of money within a specified time frame.

A sign-up bonus will look something like receive 60,000 points by spending $4,000 within three months.

This is where it’s at! This is how I get at least one free trip a year.

When you are trying to reach the minimum spend for a sign-up bonus, DO NOT buy things that you wouldn’t otherwise buy. There isn’t any sign-up bonus worth going into debt for.

To make it easier to reach a sign-up bonus, try to plan the opening of any new credit card around larger expenses like appliance purchases, car repairs, insurance premiums, or holiday shopping.

You’ll be surprised how quickly you can reach a sign-up bonus!

Which Rewards Card is Best?

There are several rewards cards out there. Each one has its own benefits, and I wouldn’t even say that one is better than the other.

It’s just about finding what works best for you.

For me, I use Chase credit cards and focus on earning Chase Ultimate Rewards points.

Here’s why I like Ultimate Rewards:

- The points don’t expire.

- The points can transfer to several airline and hotel partners including United, Southwest, and Jet Blue.

- It’s super easy to earn Ultimate Rewards points!

I stayed four nights for free in Thailand by using points earned with my IHG credit card.

How to Earn Points and Miles

Every card I have earns points or miles for every purchase, no matter what the purchase is. Depending on what it is, I may earn 1X or I may earn 5X or more.

Essentially, I put everything I can on a credit card. Pack of gum? On a credit card. Power bill? On a credit card. Car insurance? On a credit card. You get the idea.

I also try to be strategic with which card I use. I want to use the card that will give me the most points for the purchase.

For example, I have a $600 car insurance payment due. My Chase Freedom Flex card is currently offering 5X points on PayPal purchases. So, I will add my Freedom Flex card to my PayPal account and then pay my car insurance through PayPal.

That single transaction will earn me 3,000 points! $600 x 5 points = 3,000.

Between sign-up bonuses and my everyday spending, it doesn’t take long before I have a free flight!

I can also earn additional points if a friend signs up for a credit card using one of my links further down in the post. Hello new friend! 🙂

I transferred points over to United and flew to Maine for free! The flight normally would have cost me $450.

How to Redeem Points and Miles

Chase Ultimate Rewards points can be redeemed for cash back, transferred to airline or hotel partners, or used to pay for travel through the Chase travel portal.

Many people choose cash back and there is nothing wrong with doing that. I’ve certainly cashed in points when I needed a little extra money. For every 100 points you redeem for cash, you would get $1.00. That’s one cent per point.

However, I usually find that I get more value when I transfer my points to an airline.

Now you may be thinking, why not just use the cash back to pay for the flight?

Good question!

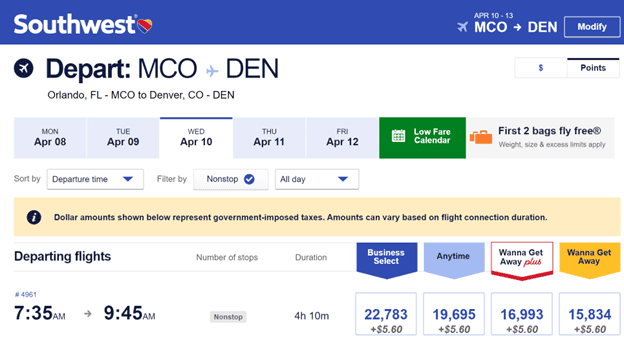

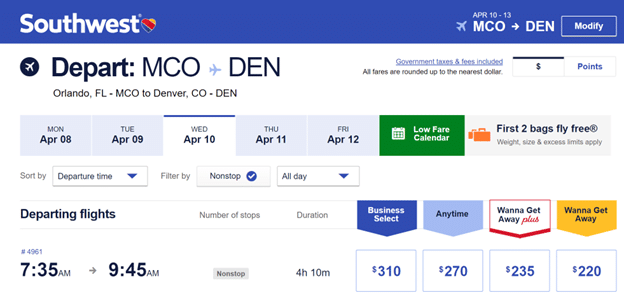

Take a look at this “Wanna Get Away” flight on Southwest Airlines flying from Orlando, FL (MCO) to Denver, CO (DEN). They are the EXACT same flight. One is the cost in dollars and the other is the cost in points.

If I wanted to redeem my Ultimate Rewards points for cash back and use that to pay the $220 for the flight, I would need to redeem 22,000 points. (remember, 100 points = $1)

Or I could transfer 15,834 points to Southwest Airlines to pay for the flight, essentially making the flight $158.34.

Which would you choose? I hope you said transfer the points to Southwest Airlines!

That’s a savings of over 6,000 Ultimate Rewards points. Points that could be used towards more travel….or, yes, even redeemed for $60 cash back!

Mind blown, right?

How Long do you Keep the Card?

After receiving the sign-up bonus for a travel credit card, you may wonder if it’s still worth it to keep the card. Well, that depends.

For me, it usually hinges on if there is an annual fee. If there is, I look to see if the benefits outweigh the fee. If they do, I’ll keep the card. If not, I’ll close the card after the first year. Simple as that.

Just make sure you’ve had the card open for a year before you close it. Otherwise, they may try and take back your sign-up bonus.

Here are the cards I use that help me travel for the least amount of money.

Chase Personal Cards

There are many cards in the Chase portfolio that earn Ultimate Rewards points. But these two are my favorites and get used all the time!

Chase Sapphire Preferred

Using the Sapphire Preferred card I earn 3X points on restaurants, 3X on streaming services, 3X on online groceries, 2X points on travel. There’s also a $50 hotel credit every year, no foreign transaction fee, Global Entry/TSA Precheck credit, car rental insurance, free DoorDash DashPass, free Instacart membership, and so much more.

I decided to keep this card because there is no annual fee, I get free cell phone insurance, AND I can earn 5X points on bonus categories like gas, PayPal, Target, wholesale clubs, etc.

Chase Co-Branded Cards

Co-branded cards are cards that are affiliated with another company as well as with Chase Bank.

They earn points or miles to use within their airline or hotel company. They do not earn Chase Ultimate Rewards.

The United Explorer card earns 2X miles on United purchases, and 2X miles on dining and hotels. It also comes with two free lounge passes every year, a statement credit for the Global Entry or TSA PreCheck application fee, a free checked bag, priority boarding, and access to additional flights for redeeming miles.

Chase Business Cards

Chase Ink Business Cash

Now that I’ve started blogging, I have a business. (Yay!) This Chase Ink card gave me 90,000 Ultimate Rewards points (or $900) for the sign-up bonus and since it has no annual fee, I’ll be keeping it.

Points and Miles have Literally Opened up the World!

From earning points through my everyday spending to redeeming them for unforgettable adventures, I feel like I am finally able to explore the world without a financial burden.

Where would you go with your points and miles?

I’d love to hear about it! Let me know in the comments below.

Resources to Book Your Trip

Flights

I like using Skyscanner to find flight deals. It searches hundreds of airlines and booking sites so you can compare prices, dates, and even airports in one place.

Accommodations

Booking.com is my go-to for hotels, guesthouses, and apartments. I like that you can filter for free cancellation and check reviews before you book.

Activities

For tours and experiences, I recommend GetYourGuide and Viator. Both have everything from walking tours to day trips, plus instant booking and mobile tickets.

eSIM

I’ve used Airalo and Saily for internet access when I travel. You can install the eSIM on your phone before you even leave home and there’s no need to swap physical SIM cards.

Airport Pickups

If you want a stress-free ride from the airport, check out Welcome Pickups. Your driver will meet you inside the terminal, help with your bags, and take you straight to your hotel.

Car Rental

Discover Cars makes it easy to compare rental companies so you get the best rate. You can see all the options and book in advance for peace of mind.